Buying a used car is exciting but it comes with risks you can’t ignore. According to the Finance & Leasing Association, over 1.4 million used cars and 650,000 new cars were purchased on finance through dealerships in the 12 months to March 2025. That means many vehicles on the second-hand market could still have outstanding finance. Failing to check could leave you with unexpected debt or legal headaches, which is why running a car finance check is absolutely essential.

Why It's Important to Perform a Car Finance Check Before Buying

When buying a used car, what you see isn’t always what you get. A vehicle might look spotless and drive well, but if it has outstanding finance tied to it, you could face unexpected legal and financial consequences.

Just as you wouldn’t buy a house without checking for a mortgage, you should never purchase a car without confirming it’s free from debt. If the car is still under a finance agreement, the lender may legally reclaim it — leaving you without the car and the money you paid.

Performing a quick car finance check helps protect you by revealing:

- Outstanding loans or hire purchase agreements attached to the vehicle

- Ownership status, confirming whether the seller has the legal right to sell the car

- Potential fraud or misrepresentation, particularly in private sales

Skipping this simple step could lead to:

- Losing the car if it’s repossessed by a finance company

- Being liable for someone else’s debt

- Facing legal disputes or long-term financial setbacks

With so many used cars on the market still under finance, a car finance check offers essential peace of mind. For a small cost and just a few minutes of your time, it’s one of the smartest and safest steps you can take before buying a vehicle.

While checking a car's finance status protects you from inherited debt, understanding your own credit score is just as important when securing the best loan terms.

Why Your Credit Score Impacts Car Loan Rates

Your credit score is like a report card for how well you handle money. It affects the interest rate you'll get on a car loan. The better your score, the less interest you'll pay. This can save you a lot of money over time.

If you're thinking about getting a car loan, it's a good idea to check your credit score first. You can often get this for free from your bank or credit card company. If your score isn't great, try to improve it before applying for a loan. This could mean paying bills on time or fixing mistakes on your credit report.

A good credit score can open doors to better financing options. Lenders may offer you lower interest rates, more flexible repayment terms, and higher loan amounts. On the other hand, a poor credit score might limit your options and result in higher interest rates, increasing the overall cost of your car purchase.

Remember, learning about car history checks is also important when buying a used car. It helps you know everything about the car's past.

Now that you understand how your credit score affects loan rates, let’s break down the key terms you’ll come across when comparing car finance offers.

Understanding the Terms of a Car Loan

When you're looking at car loans, there are a few key things to understand:

- APR (Annual Percentage Rate): Includes the interest and any fees, showing the real yearly cost of borrowing.

- Loan Term: How long you'll repay the loan. Longer terms lower monthly payments but cost more in interest.

- Loan-to-Value (LTV) Ratio: The percentage of the car’s value being financed. Lower LTV = better terms.

- Monthly Payment: The amount you’ll pay each month toward your loan. Lower payments may seem attractive, but can mean a longer loan term and more interest paid over time.

It's not just about finding the lowest monthly payment. You need to look at all these parts together to find the best deal. Sometimes, a longer loan term might mean lower monthly payments, but you could end up paying more in total because of interest.

If you're interested in electric cars, you can learn about financing options for electric vehicles too. They might have special deals or incentives.

Common Mistakes to Avoid When Financing a Car

When getting a car loan, people often make these mistakes:

- Focusing Only on Monthly Payments

Many buyers focus solely on the monthly payment without considering the total cost of the loan. This can lead to paying much more in interest over time. - Skipping Credit Report Checks

Skipping a credit report check may leave you unaware of errors or negative items that could impact your ability to secure a good loan offer. Always review your credit report before applying. - Not Getting Pre-Approved

Without pre-approval, you may not know what financing terms you actually qualify for, and you could end up agreeing to less favourable terms at the dealership. - Ignoring the Full Loan Term

Ignoring the loan term can result in paying significantly more over the life of the loan. A longer term may lower monthly payments but increase total interest paid. - Forgetting to Negotiate the Car Price

Failing to negotiate the price of the car first can lead to financing a larger amount than necessary. Always negotiate the car price separately before discussing loan options

To avoid these mistakes, take your time and do your research. Discover valuable insights on buying used cars to help you make smart choices.

How to Perform a Car Finance Check in 8 Easy Steps

Before buying a used car, it’s essential to check whether there’s any outstanding finance attached to it. This guide will walk you through the process in 8 simple steps.

- Check your own credit score

- Set a realistic budget based on what you can afford

- Explore different car loan options

- Get pre-approved for a loan

- Review your loan contract carefully

- Use a reputable car history check service

- Verify the seller's information

- Consider getting an independent vehicle inspection

By following these steps, you'll avoid surprises and make a more secure purchase.

If you want to know more about checking cars, you can learn about understanding VIN numbers and their importance in car checks. This can help you get even more information about a car.

What Happens If You Cannot Pay Your Car Loan?

Falling behind on your car loan payments can lead to serious financial consequences. It’s important to understand the risks so you can take action early if you’re struggling to keep up. If you miss payments, you could face:

- A drop in your credit score

- Repossession of your vehicle by the lender

- Difficulty securing future loans or credit

- Potential legal action from the lender

- Additional fees and penalties added to your account

To avoid these outcomes, always make sure your loan is affordable before signing the agreement. If unexpected financial difficulties arise, contact your lender as soon as possible, they may be able to offer solutions such as payment deferrals or loan restructuring.

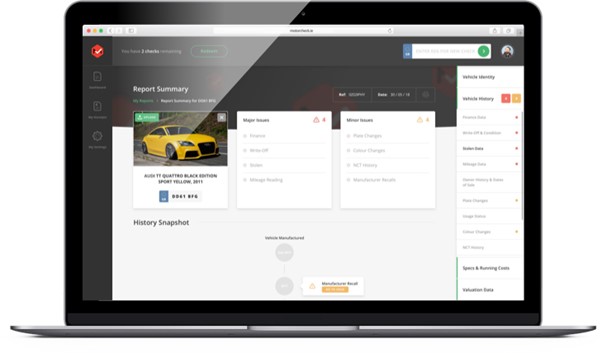

MotorCheck Can Help with Your Car Finance Check

Worried a car might still have finance owing on it? That’s where MotorCheck comes in. It’s a fast, reliable service that gives you a complete picture of a used car’s financial and ownership history before you commit to buying.

What Does a MotorCheck Report Include?

MotorCheck's comprehensive reports include information on outstanding finance, as well as details about the car's history, such as previous owners, mileage discrepancies, and accident records. This holistic approach ensures you have all the necessary information to make an informed decision about your potential purchase.

If you want to know more about checking cars, you can learn about understanding VIN numbers and their importance in car checks.

Final Tips for a Safe & Smart Car Purchase

Checking for outstanding car finance is one of the most important steps when buying a used vehicle. It protects you from hidden debts, legal issues, and financial loss. Always take the time to research the car’s history, verify the seller’s information, and use trusted services like MotorCheck for added peace of mind.

By following these steps, you’ll be well on your way to a confident, stress-free purchase.

If you have more questions, check out our frequently asked questions about car finance checks. We're here to help you make the best choice for your next car.

FAQs About Car Finance Checks

Can I check if my car has outstanding finance?

Yes. With MotorCheck, you can quickly find out if a car has any existing finance agreements. Just enter the vehicle’s registration number, and you’ll receive a full finance status update from verified data sources.

Can I check car finance for free?

Free vehicle checks may provide basic information, but they won’t tell you if a car has outstanding finance. MotorCheck offers an affordable, trusted car finance check that pulls verified data from official sources. For a small fee, you can avoid costly mistakes and ensure the car is free of debt, an essential step for any used car buyer.

How Can I Check the Full History of a Car?

MotorCheck makes it easy to check a car’s full history in one simple report. Along with outstanding finance, we check for previous owners, mileage discrepancies, write-offs, theft status, MOT history, and more. Just enter the registration number on our website — our report gives you all the key facts so you can make an informed buying decision.

What is the 50% Car Finance Rule?

The 50% car finance rule, often linked to voluntary termination, allows you to end certain UK finance agreements (such as Personal Contract Purchase or Hire Purchase) once you’ve repaid at least half of the total finance amount. If you’re buying a used car, it’s important to know if a vehicle is still subject to such an agreement. MotorCheck’s finance check will alert you to any existing finance so you can avoid taking on someone else’s debt.